Introduction

In 2025, finance apps go beyond tracking expenses—they help users invest wisely, save automatically, and achieve financial freedom through smart AI tools and real-time insights.

1. FinSync – Your Smart Budget Partner

Category: Personal Finance Manager

FinSync helps you control your money effortlessly:

- Automatic expense categorization

- AI-based budget recommendations

- Real-time spending alerts

- Bill reminders and savings goals

- Multi-account integration

2. InvestIQ – Smarter Investing for Everyone

Category: Investment Platform

InvestIQ simplifies investing with AI insights:

- Personalized portfolio suggestions

- Real-time stock and crypto analysis

- Risk management advisor

- Educational tutorials for beginners

- Instant trade execution

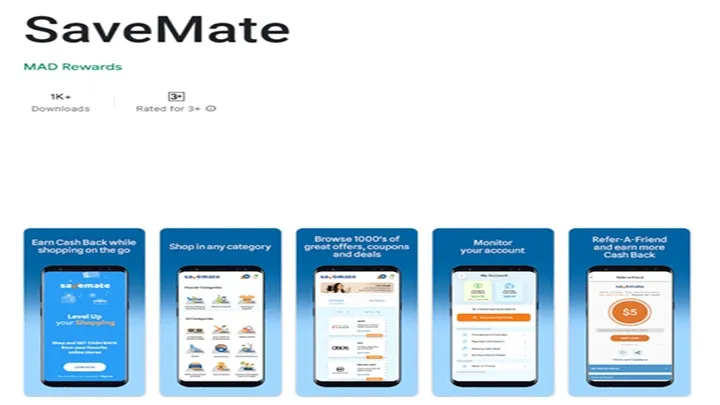

3. SaveMate – Build Wealth Daily

Category: Savings & Goals App

SaveMate makes saving fun and easy:

- AI tracks spending habits

- Auto-save spare change

- Smart goal planner

- Daily saving challenges

- Visual progress dashboard

4. CryptoVault+ – Secure Digital Assets

Category: Cryptocurrency Wallet

CryptoVault+ keeps your crypto safe and accessible:

- Multi-currency support

- AI security threat detection

- Real-time market trends

- Cold storage protection

- Instant swap and transfer options

5. TaxEase AI – Simplify Your Taxes

Category: Tax Management App

TaxEase AI saves time and stress during tax season:

- Auto-scan invoices and receipts

- AI tax deduction finder

- Income summary generation

- Secure cloud filing

- 24/7 AI support assistant

Conclusion

The Top 5 Finance Apps of 2025—FinSync, InvestIQ, SaveMate, CryptoVault+, and TaxEase AI—make money management smarter, safer, and more effortless than ever.